By David Flemming

S&P Global Ratings changed its outlook for two major types of bonds to negative last week.

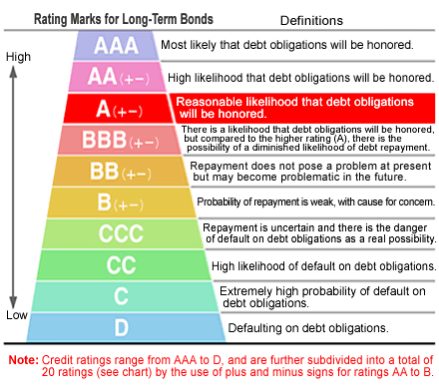

Vermont’s general obligation debt and the Vermont State College bonds outstanding each had a “stable” outlook after being downgraded from AAA in 2018, but both were changed to a negative outlook after a press release last week.

This means Vermont’s “AA+” rating on its general obligation debt and the “AA-” rating on State College bonds are both in danger of being dropped lower. Should this happen, it will get more expensive for Vermont and its colleges to borrow money to finance their debt. “There is at least a one-in-three chance” this downgrade could happen, said S&P Global Ratings credit analyst Jillian Legnos.

Legnos lists several factors in her reasoning. First, “Vermont’s unfunded retirement liabilities have grown [and] … face heightened budgetary challenges.” Second, “older-aged states reliant on older and higher-income households are more likely to experience revenue declines, in part the result of falling incomes at retirement.”

Legnos lists several factors in her reasoning. First, “Vermont’s unfunded retirement liabilities have grown [and] … face heightened budgetary challenges.” Second, “older-aged states reliant on older and higher-income households are more likely to experience revenue declines, in part the result of falling incomes at retirement.”

Third, while Vermont has “programs to retain college students and attract remote workers … the long-term effects of these developments are currently unclear.”

So clearly, Vermont’s more troubling long-term aging and population stagnation trends weigh more heavily than short term positive trends that may or may not continue.

In a seeming nod to the growing risk of climate change, S&P notes that Vermont’s “environmental risks are somewhat elevated because of the potential for severe flooding events along river corridors.” And S&P doesn’t list Vermont’s efforts to reduce our 0.01% share of world CO2 emissions. Perhaps S&P might go easier on Vermont if we took some of the millions spent on mitigating emissions and put it toward shoring up our environmental treasures.

But the biggest way to move the needle is perhaps the most difficult task: achieving “population gains driven by improved migration trends” and making sure Vermont’s “finances remain structurally balanced.” If this happens, that “could revise the (S&P) outlook back to stable.”

Population gains have been elusive even as Vermont has passed a bevy of progressive policies in the past decade: the OneCare experiment currently dying a slow death, a minimum wage consistently among the highest in the region, millions of investment in “green energy,” while preserving an unfriendly to business reputation. In order to get out of our demographic rut, perhaps we should reconsider such policies.

David Flemming is a policy analyst for the Ethan Allen Institute. Reprinted with permission from the Ethan Allen Institute Blog.

A first step own the rating ladder will not be our last as Vermont’s Vacation and Tourism (and the related revenues) continue to disintegrate in the upcoming year. Many businesses have passed the financial point of no return and are only able to keep their doors open because of the temporary COVID Federal support which will evaporate long before the lockdown injuries have been cured !

So the credit rating experts at S&P are now incorporating the extreme complexity of climate change into its bond ratings……I would be suspicious of this based on S&P’s past difficulties in simply rating packages of home mortgages.

Back in the early 2000’s, S&P along with the other rating agencies gladly slapped AAA ratings on hundreds of billions of dollars of bonds backed by home mortgages……These securities were called Collateral Debt Obligations or CDOs and ultimately nearly destroyed the US economy starting in 2008.

You’ll remember the disaster that swept the country as Wall Street banks nearly or actually collapsed under the weight of illiquid CDOs caused by the defaulting mortgages they held ……This financial disaster was trigger by S&P and the other rating agencies not knowing what they were doing when rating CDOs, or packages of mortgages, as AAA.

Now, if S&P couldn’t understand the risks in packages of home mortgages, what makes anyone think they are qualified to credibly assign risk based on climate change?…….Maybe Vermont State Treasurer Beth Pearce may want to ask S&P to show her the math behind the climate change driven ratings down grades.

Great point. Standard & Poors and Moody’s have a dubious track record, to say the least. It remains to be seen who will profit from the next ‘Big Short’.

Of course, VT government spending will cost taxpayers more. When has this occurrence ever changed? This despite the fact that ‘Vermont’s state revenues went way up in September, despite pandemic’ …as reported on VT Digger.

“Overall, the state government’s general fund took in $166 million, $31.5 million more than expected last month — a 23.4% increase above the estimates state officials set in August.”

“The state’s education fund took in $48.5 million, about $6 million more than expected. Receipts from sales and use taxes and motor vehicle purchase and use taxes ran ahead of projections.”

Are there ‘uncertainties’ looking forward? You bet. It seems everything the Vermont legislature does is ‘uncertain’.

Not to mention, anecdotally, that I received an increase in my property taxes just yesterday because the Education Tax increased – again!

One thing is certain. Not only are taxes unlikely to decrease, they are likely to continue to increase while the monster demands more from its taxpayer funded annuity.

October state revenue higher than expectations – which were set very low, administration says

GUY PAGE NOVEMBER 20, 2020

“The State’s General Fund, Transportation Fund, and Education Fund receipts were $18.27 million, or 10.1%, above expectations in October.”

The money train keeps rolling on.

There is a fine line between Montpelier’s Spending and Robbery.

Perhaps an article is needed to lay this out there- they didn’t seem to get that memo.

#TaxationIsTheft

#GetOffMyLawn

Isn’t that what this TNR editorial and its commentary are all about? What of the many previous TNR articles, those describing in detail our legislative inefficiencies, while expressing, in equal detail, the benefit free markets and limited governments enable, published for anyone who would care to read them? What more would you propose? What am I missing?

Judging from this article, they haven’t read them.

Not true. People like John Freitag read them. My question remains. What more do you propose we do?