By Rob Roper

During Covid, the federal government funded a program providing universal school meals free of charge to all Vermont students. With Covid (hopefully) in the rear-view mirror, that funding dried up after the 2021-22 school year. But, as Ronald Reagan once warned, “Government programs, once launched, never disappear. Actually, a government bureau is the nearest thing to eternal life we’ll ever see on this earth!” And such looks to be the case with universal school meals.

In the spring of 2022, Vermont used $29 million of our own surplus education fund money to extend the program for one more year. Now there is no surplus education fund money, or federal money, but the legislature wants to extend the program again, as Reagan might have predicted, forever.

On Tuesday, February 7, the House Ways & Means Committee put their heads together with the Joint Fiscal Office to discuss some of the options for squeezing the what is now estimated to be as much as $31 million per year out of Vermont taxpayers’s pockets.

Option one is to allow the increase to fall on the property tax. The rough calculation is that for every penny increase on both the homestead and non-homestead property tax rates, the education fund gets $10 million, so this would mean roughly a three-cent increase.

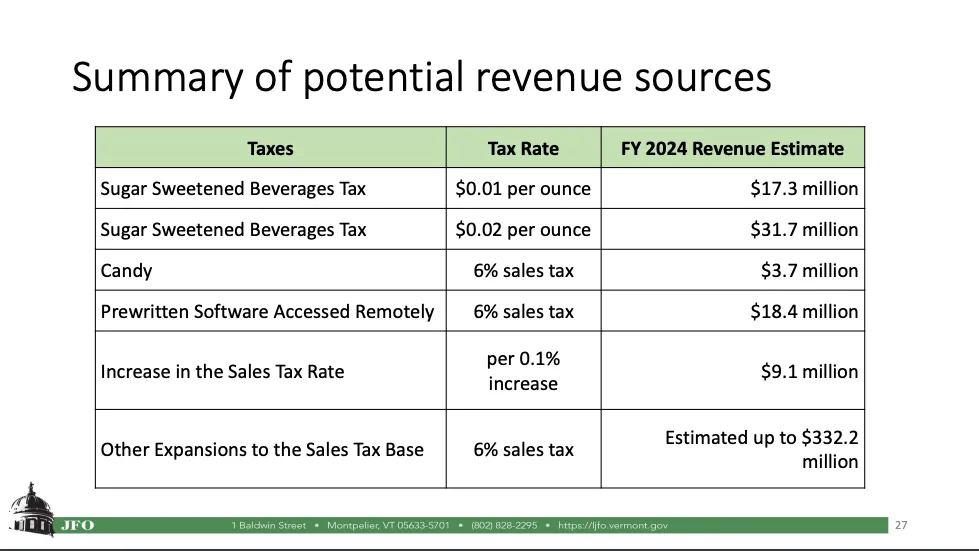

The other options on the table are a 2¢ per ounce tax on sugar sweetened beverages ($31.7 million), an increase in the current sales and use tax to 6.4% % ($36 million), expansion of the 6% sales and use tax to include “cloud” software services ($18.4 million) and/or to candy ($3.7 million) and/or to some other area currently exempted from the sales tax such as clothing.

A property tax increase didn’t seem to spark much interest in the committee. The sugar sweetened beverage tax did garner some discussion and spit-balling. Rep. Katherine Sims (D-Craftsbury) made a suggestion to tax all soda regardless of how it is sweetened but at a lower rate, and Rep. Carol Ode (D-Burlington) suggested taxing all canned and bottled beverages. Asked if this would include bottled water and milk, she backpedaled to make exceptions for things with nutritional value, explaining that her tax would just apply to what was fun – or a “fun tax” as she termed it. (Though she was kidding, one has to wonder with this crowd)

However, there were some reservations about the regressive nature of these types of “sin” taxes and Rep. Jim Masland (D-Thetford) pointed out that large chain stores can spread excise taxes such as this across a large inventory of products (they don’t have to be applied directly to the product at point of purchase, but are paid by the retailer when purchasing from the distributor as a general cost of doing business). Small mom and pop stores can’t really do that. Moreover, adding 24 cents to a twelve ounce can of soda or $5.76 to a case of twenty-four would be yet another powerful incentive for Vermonters to hop over to New Hampshire to do their shopping tax free.

These good arguments weren’t enough for Masland to take the idea of a sugar sweetened beverage tax off the table entirely, but at least they gave him pause.

The idea that got the most traction was the “Cloud Tax” which seems to come back every session like a bad penny (or six of them for every dollar spent).

This would add the 6 percent sales tax to “prewritten software accessed remotely,” or “software, platform, and infrastructure as a service.” such as data storage and web hosting. Examples given included things like Turbotax and Quickbooks, Microsoft Office Online, Dropbox, Mail Chimp, Google Apps (like Docs, Sheets, etc.), Toast and Square, Squarespace web design, Force.com (as part of Salesforce), Amazon Web Services, and Google Compute Engine.

This option was attractive to the committee because, for one reason, it is a growing sector of the economy and is likely to bring in increasing levels of revenue each year without having to raise the rate. The problem with it is that it only gets to a little over half of the money necessary to fund the program, and so something else will have to be tapped as well.

The other problem with it — and the reason it comes up every year but doesn’t pass — is that the tech sector in Vermont is a bright spot in our in our economy that generates good paying jots. We want to encourage, not discourage these companies and others like them. And, it’s worth pointing out, that a lot the services that would fall under this tax are the very technologies that allow people and businesses to work from anywhere — like places without this tax.

If all of these suggested revenue sources sound familiar, it is because they are all being targeted by multiple programs that want funding. Just because the soda tax won’t be implemented to pay for this universal school meals program doesn’t mean it won’t be tapped to pay for expanded childcare. And, if our lawmakers decide that a 3 cent increase in the property tax rate is the way to go here, the Cloud Tax will be a prime target to pay for EV charging stations. I wouldn’t be surprised if Rep. Ode’s “fun tax” comes back for more serious consideration at a future date.

Unlike the average middle school kid’s appetite for school cafeteria food, free or not, the appetite for our money that these people have has no end.

Rob Roper is a freelance writer who has been involved with Vermont politics and policy for over 20 years. This article reprinted with permission from Behind the Lines: Rob Roper on Vermont Politics, robertroper.substack.com

I hope that the legislature does their due dilligence into how the current program is implemented. They need to speak with more than just the advocates/administrators. They need to speak with the workers in the cafeteria, the teachers who do cafeteria duty even the building maintenace folks.

I have spoken to 3 sources who have observed similar programs in Connecticut and New Jersey, They are teachers and board of Ed employees. What they have told me is that there is a horrendous amount of wasted food that is just thrown into the trash. It’s free so students just throw away anything they don’t want. Perfectly good fruit and vegetables, apples and even whole meals are put in the trash. The teachers that I spoke to were astounded and disgusted by the amount of waste.

Vermont tax payers should not be required to pay for food that will not be eaten. Legislators need to be responsible guardians of our ta dollars.

School breakfast and lunch programs are proven to ensure better learning. Forty percent of school kids make their own breakfast. This of course ensures an imbalance of foods needed to supply a constant level of glucose in the bloodstream. When glucose levels fall, students become sleepy, irritable, easily distracted. An oversupply can make them hyper, but the simple sugars usually eaten at breakfast are the first to be converted to glucose, and disappear rapidly– often before the bus arrives at school. The more complex sugars take longer to digest and provide a steady supply for a longer time, but do that 40% have fruits and vegetables for their breakfast? Fats take much longer to convert to glucose, so they carry the load from mid-morning to lunch time. But they’re of little use for the first several hours.

So, do we want other people’s children to do well in school?