Monthly Revenue Release – May 8, 2020

Vermont Agency of Administration

Revenue collections for the month of April 2020 have been compiled. April is the first full month of revenue collections since a State of Emergency was declared by Governor Scott on March 13, 2020, and the subsequent mitigation “Stay Home Stay Safe” Order was issued on March 24, 2020 to slow and suppress the spread of COVID-19. April revenues collected were predictably and dramatically under the consensus forecast for the month.

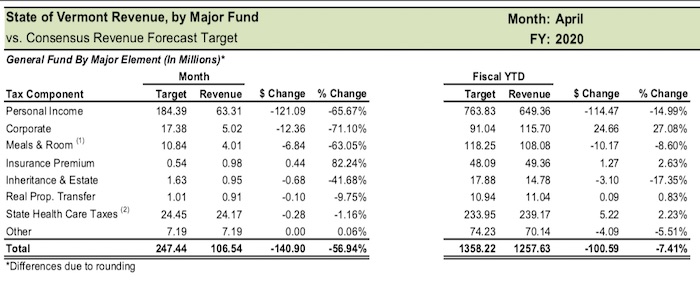

General Fund revenues collected for the month totaled $106.54 million, or -$140.90 million (-56.94%) below their monthly target. In particular, the largest factor in the underperformance was the extension of the federal and state filing deadlines for personal income taxes from April 15 to July 15, 2020. April is typically the largest collections month of the year. The Tax Department reports that 39,000 fewer tax returns were filed in April 2020 compared to April 2019. All major General Fund revenue sources per- formed below their expectations for the month.

Additionally, the deferrals granted for COVID-19 impacted taxpayers in the bar, restaurant, lodging and retail businesses are reflected in Meals And Rooms Tax collected, which are down -$6.8 million versus April expectations in the General Fund and -$2.4 million in the Education Fund. Sales and Use Tax collections were $5.1 million below the April consensus expectations for the Education Fund as well.

“These results are not unexpected in light of the extension of filing deadlines and deferral of pay- ments,” said Agency of Administration Secretary Young. “A recent risk assessment by the state and legislative economists projected that of the $191 million of taxes deferred from the general fund in fis- cal 2020, $143 million will ultimately be collected in the next fiscal year, while $48 million may be lost permanently. That estimate did not take into account the most recent actions taken by the Governor to re-open certain sectors of the economy in the coming weeks and months. If recent steps announced are implemented successfully by not increasing public health concerns, then that assessment will likely change and May revenues could improve compared to April.”

Year-to-date, General Fund revenues are -$100.59 million (-7.41%) below their target. Secretary Young noted: “The State was very fortunate to have experienced strong fiscal performance prior to the COVID-19 pandemic and entered this period with healthy reserves and a predicted surplus, factors that will help lessen the blow dealt by this national emergency.”

The Transportation Fund was -$5.89 million, or -23.58%, below its target for the month, bringing in $19.11 million. Year-to-date, Transportation Fund revenues are -$7.44 million (-3.26%) below expecta- tions. In particular, motor vehicle purchase and use tax revenues and motor vehicle fee revenues per- formed below expectations.

The Education Fund was -$10.09 million, or -20.97%, below its monthly target, having collected $38.01 million for the month and was -$11.23 million, or -2.41%, below year-to–date expectations. All state-wide revenue sources attributed to this fund performed below expectations.

Note: Adjusting for redirection of certain healthcare-related taxes under Act 6 of 2019 and redistribu- tion of the meals and rooms tax under Act 76 of 2019, for comparison purposes only, in the accompa- nying General Fund tables, the year-to-date revenues for April 2020 represent changes of -7.98%, -2.51%, and +3.49% for the General Fund, Transportation Fund, and Education Fund, respectively, from the same period in FY 2019.

We are now at the point where the liberals cannot tax their way out of the problems they have created. I can’t wait to see what they try next. I find it interesting because I don’t think they are collectively smart enough to know where we are or what to do about it.

This November will also tell us if there are enough smart people left in Vermont to make it worth trying to live here. I don’t think there are, but one can always hope. For myself, its probably time to accept a loss on selling the house and leaving while I still have clothes to wear.

No problem.

Just tax the rich some more, per knee jerk response

That’s exactly why I left VT years ago. Tired of constantly having a target on my back because out family is highly educated with excellent income. It wasn’t if I was going to take it on the chin, it was a matter of when. Glad I got out when I did. Looking at VT in the rear view mirror has put a lot of extra money towards my families security and our kids higher education.

It’s quite simple to increase the ‘rich’ population in the State – just lower the income bar and voila! More rich to tax.

That’s exactly what will happen. Many people will be very disappointed to discover they are now rich, or at least considered so by the State.