By Brent Addleman | The Center Square

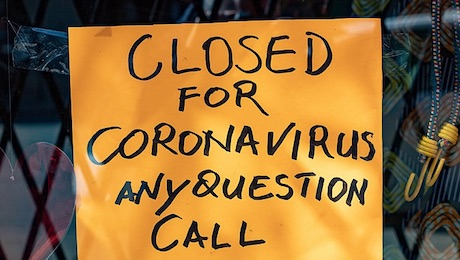

A short-term forgivable loan program is now open to businesses in Vermont.

The Short-Term Forgivable Loan Program, which will be run through the Agency of Commerce and Community Development and the Vermont Economic Development Authority, launched Thursday and is designed to help businesses that are still seeing working capital shortfalls stemming from the COVID-19 pandemic, Gov. Phil Scott said.

According to the release, applicants must be able to show a reduction in adjusted net operating income that is at least 22.5% in 2020 and 2021 when compared to its 2019 figures.

“Supporting businesses in every region of the state to recover and rebuild remains a top priority of my administration, and that’s why we worked to secure this funding from the Legislature,” Scott said in a release. “This will help those businesses disproportionately impacted by the pandemic remain in operation, preserve jobs, and strengthen the economy.”

Senate Bill 11, known as Act 183, will send $19 million of the state’s American Rescue Plan Act funding to eligible businesses, including sole-propietors and not-for-profits, financial aid as they continue to recoup economic harm related to the pandemic. Applicants can receive up to $350,000.

According to the release, applicants must be able to show a reduction in adjusted net operating income that is at least 22.5% in 2020 and 2021 when compared to its 2019 figures. The businesses must include funding from prior programs was received that did not completely help the businesses from ongoing economic hardships.

“The health of Vermont’s economy is dependent on the health of the small business community and the intent of this program is to help businesses with their cash flow needs to get back on stable footing so they can thrive beyond the pandemic,” VEDA’s Chief Executive Officer Cassie Polhemus said in the release. “VEDA’s expertise in small business financing combined with our previous work in administering similar programs such as the SBA Paycheck Protection Program positions us well to help these businesses access this money so they can continue providing the goods and services that are vital to us as consumers and to fuel the Vermont economy.”

According to the release, the program is designed to make sure all loans will be forgiven if proceeds are spent on eligible operating costs. Plus, there will be no restrictions placed on how the funds are spent, but only that the money is used for operating expenses, including payroll, mortgage interest, rent, and utilities.

The hardest hit business sectors, according to the release, that will receive funding include travel and tourism, food service, lodging, child care, and agriculture. Priority will be given to Black, indigenous and people of color businesses in all industry sectors.

Applications will be processed on a first-come, first-served basis, according to the release. Applicants are urged to contact the Vermont Small Business Development Center for assistance.

VEDA will host a live information session Monday at 2 p.m. Registration for the event is encouraged.

should be named “Money burns a hole in States pocket bill”

this is a racist program……end of story and so unbelievable, to say nothing about more free money….this state cant hold onto $$ for rainy day, burns hole in their pocket …and a rainy day is coming……holy moly

VOTE …….

Don’t enslave yourself with debt!

Don’t do it..

Taking the governments bribe money now means you are owned and no longer free..

Do not put yourself in a position where your entire life is all about paying money back.

Another case of the arsonist showing up with a garden hose to put out the fire they never should have lit. And, prioritizing funds to anyone based on the color of their skin is RACIST….period. I would encourage every applicant to this program to identify as black or indigenous.